Salary Payment Rules in India: What Every Employer Must Know in 2025

Let’s start with something every founder or HR head knows in their soul but rarely admits out loud: salary payment rules in India are intricate and multifaceted. They are subject to frequent changes and thus demand a constant learning curve, and most of the time, can be quite challenging to navigate.

Sure, you think you’re just “processing payroll.” What you’re actually doing is stepping into a legal obstacle course full of complex rules and regulations.

But if you want to run a legitimate business, you must pay your people on time, follow the law, and would not want to get fined ₹50,000 because you didn’t file something called a Form 16. This post is your map through understanding the salary payment date rules in India and other crucial compliances.

Are You Compliant with Salary Payment Rules in India?

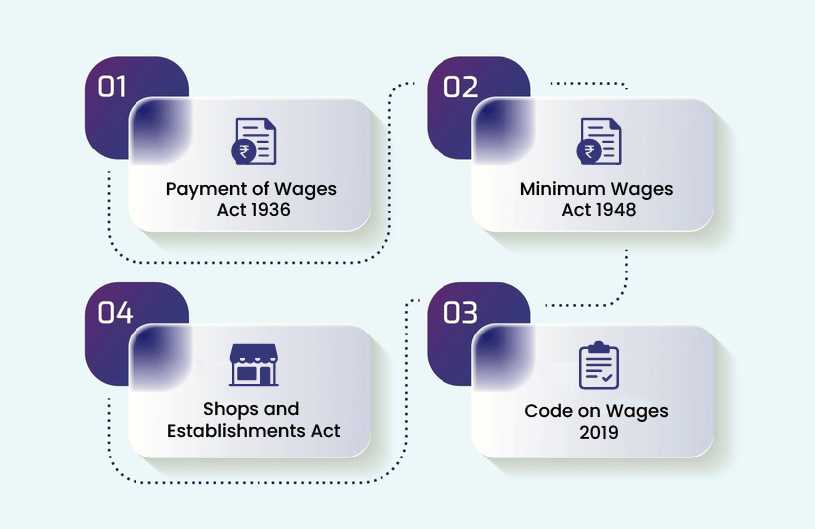

First, let’s try to understand the basics. Salary payment rules in India aren’t governed by one law. That would have been too easy if that were the case. But of course, they’re spread across:

- The Payment of Wages Act, 1936

- The Minimum Wages Act, 1948

- The Shops and Establishments Act (which varies by state)

- The Code on Wages, 2019

If you’re wondering, “But didn’t we move to UPI and AI and all that?” Yes, we did, but that doesn’t mean salary compliance caught up. It is still stuck in a world where digitisation only goes so far.

Salary Payment Date Rules in India - What Applies?

The golden rule is to pay your employees within 7 days of the end of the wage period. If your headcount is over 1,000, you get up to 10 days. That’s it.

If an employee is laid off, resigns, or is terminated, their full and final settlement must be completed within 2 working days.

Yes, even if your payroll executive is on leave, the accountant is unavailable, or the CTO says it is not their job, it still has to be done in two working days. Failure to do so (keeping the compliances) can lead to fines, legal notices, visits from labour inspectors and sometimes, a tweet by the employee that gets more attention than you’d like.

Salary Payment Timeline and Scenarios

| Scenario | Deadline | Applicable Rule/Act |

|---|---|---|

| Regular salary payment (≤ 1000 workers) | Within 7 days of the wage period end | Payment of Wages Act, 1936 |

| Regular salary payment (> 1000 workers) | Within 10 days of the wage period end | Payment of Wages Act, 1936 |

| Resignation/termination settlement | Within 2 working days | Shops & Establishments Act (State-specific) |

| Delay in salary | Can attract a penalty (up to ₹50,000) | Code on Wages, 2019 (when active) |

How to Pay (Definitely Not With Envelopes of Cash) Employees?

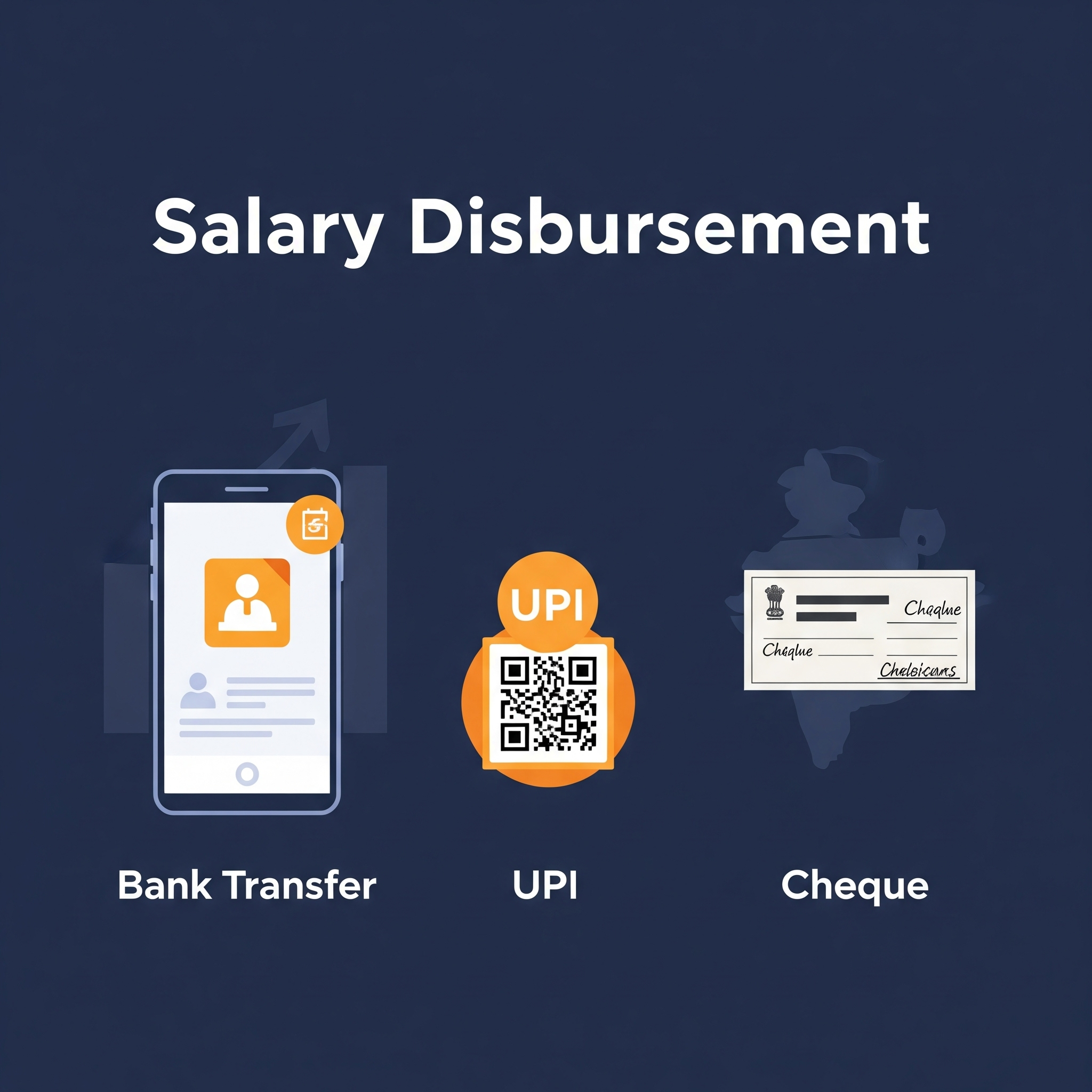

Salary payment mode as per labour law is that you’re supposed to pay your employees via:

- Bank transfers

- Electronic clearing

- Cheques

Cash is technically allowed only in exceptional cases, and even then, it comes with documentation and paperwork that would make you wish you'd just set up a bank transfer instead.

The salary payment rules in India also require that you:

- Issue a payslip.

- Mention all deductions.

- Be ready to explain them if someone files a complaint.

What Can Legally Be Deducted from Your Salary?

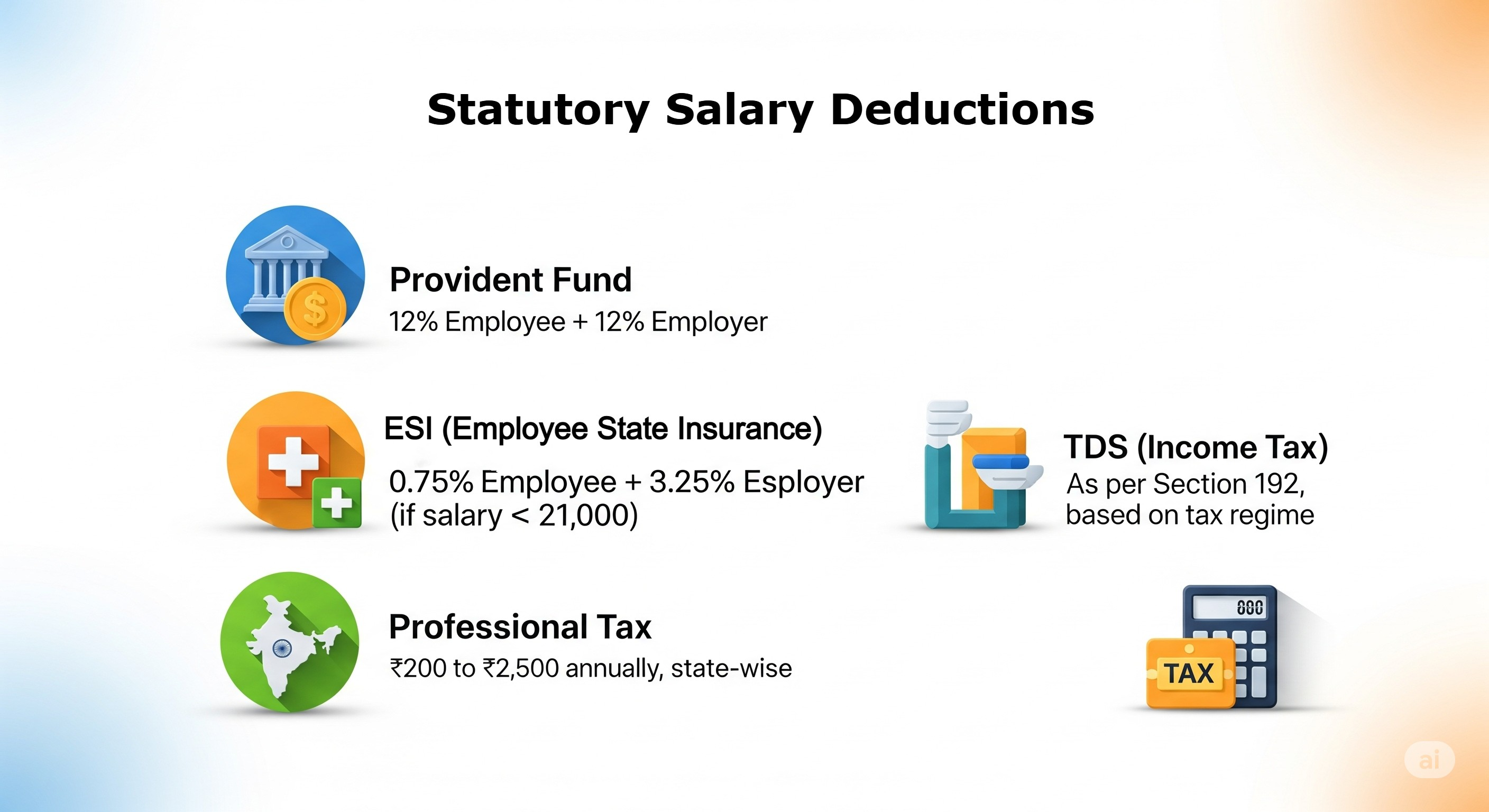

When any discussions around salary payment rules in India come up, you cannot ignore statutory deductions. Interestingly, it is the part of the salary slip that only a few understand.

- Provident Fund (PF) – 12% from employee, 12% from employer. Non-negotiable.

- Employee State Insurance (ESI) – 0.75% employee + 3.25% employer if gross is under ₹21,000.

- Professional Tax – State-specific, ranging from ₹200 to ₹2,500 annually. Employers must deduct and remit it to state authorities monthly.

- TDS (Income Tax) – Deducted under Section 192 based on your salary and your chosen tax regime (old or new). Your HR or finance team must apply the correct rates after you declare your regime preference.

The law makes it clear that you cannot deduct random charges from an employee’s salary. No security deposit. No canteen maintenance charge. No convenience fee.

Understanding the Wage Code - What It Means for You?

The Code on Wages, 2019, is a major update to salary payment rules in India. It hasn’t been implemented yet, but when it is, here’s what will change:

- The definition of wages will get expanded. No employers will be able to stack up 37 allowances to reduce PF liability.

- If your basic + DA < 50% of total CTC, you’re doing it wrong (and may owe arrears).

- Uniform applicability across organised + unorganised sectors.

In short, when this gets the green light, payroll structuring as you know it now will be dead. It will be time to get more serious about compliance.

What Happens If You Don’t Fix Payroll Mistakes?

Every founder has muttered, “Let’s just get through this month and fix it next time.” The intention is adorable. But in practice, it is illegal because as long as you don’t tick the checkboxes of payroll compliance in India, you are not operating legally.

Here’s what can help you instead:

- Use payroll management software to auto-calculate compliance (Mewurk is a smart option in this regard).

- Set calendar reminders for filing deadlines (or better: automate them).

- Generate and store payslips digitally.

- Document salary structures in appointment letters.

- Keep logs of salary revisions, settlements, and full & final statements.

Pro tip: If your HR software can’t export Form 16s or compute PF in one click, be quick to realise that more than a software, it’s a liability for you.

What Will You Be Fined For If You Don’t Follow Salary Payment Rules in India?

If you thought salary compliance meant just paying people and that delays at times are just a matter of understanding between you and your employees, it is not. You may be held legally liable for:

- Delaying salary, even by a day. Because labour law for salary delay in India clearly states that wages must be paid within 7 working days after the end of the wage period (10 days for larger establishments).

- Not displaying the Minimum Wages Act, 1948, at the workplace.

- Failing to maintain a register of wages (physical or digital).

- Not giving a breakup of gross salary.

- Forgetting to issue the final payslip at exit.

Each comes with its own fine, sometimes in rupees, sometimes in legal entanglements.

Final Thoughts

Most employees won’t notice if their PF number isn’t linked or their payslip is missing until they need a loan, leave an organisation or get a job at a company that handles these things properly and systematically. Then suddenly you’re held responsible for the oversight.

If you assume that keeping compliance with salary payment rules in India is optional or push for later, think again. A missed payroll step doesn’t take long to escalate into a legal issue. And when it does, it’s the employer or HR team that’s held accountable.

Looking for a smarter way to manage payroll?

Let Mewurk handle the salary math, deductions, deadlines, and digital filing. Book a free demo today and see how effortless compliance can be.

FAQ

What are the salary payment date rules in India for government employees?

Government employees usually receive their salaries on a fixed monthly date. Private employees, in contrast, receive their salaries within 7 or 10 days of the wage period end (variable according to the employee headcount of the organisation.

What are the penalties for late salary payment in India?

There is a solid labour law for salary delay in India. As per this, late issuance of salaries can result in the employer being fined up to ₹50,000 and facing legal action under the Code on Wages.

What is the minimum salary in India as per labour law?

There’s no single centralised minimum salary accepted nationwide. It varies by state, job type, and skill level as per the Minimum Wages Act, 1948, and is updated periodically by each state government.

Do salary payment rules in India mandate a full and final settlement when the employee exists?

Yes. As per most state-specific Shops and Establishments Acts, which govern salary payment rules in India, a full and final settlement must be completed within 2 working days after an employee resigns. The same rule applies in the cases of termination or laying off.

What are the 26 days minimum wage rules in India?

The 26 days minimum wage rules mean wages are calculated based on 26 working days per month. Technically, it excludes weekly offs and allows for accurate and fair daily wage calculation as per the labour laws.

Most Popular Post

Why Accurate Attendance and Leave Management Matters for Business Growth?

Read More →Why Accurate Attendance and Leave Management Matters for Business Growth?

How To Leverage Attendance Data For Better Workforce Management?

Read More →How To Leverage Attendance Data For Better Workforce Management?